Checkout.com / Multiple currencies

Introduced multi-currency features to retain customers, reduce exchange rate fees, streamline existing workflows, and achieve an 8.98% quarterly revenue growth.

TIMELINE / 3-4 months (Feb 2023 - May 2023)

RESPONSIBILITIES / UX, research, visual design

Summary

As the design lead on this project, my primary challenge was to reduce recurring exchange rate fees for our Integrated Platform customers. Before starting, the Q2 business FX fee intake was 0.15%, creating additional difficulties in retaining customers.

To address this, I developed a multi-currency switch for the dashboard, allowing customers to filter client data by currency and add multiple bank accounts for payouts in their preferred currencies, all without disrupting their existing workflows.

This resulted in an 8.98% quarterly revenue increase, from $325,537 to $354,764 and a 60% reduction in FX fees, from 0.15% to 0.06%.

Quarterly business revenue

Metrics of success

$325,537 to $354,764

8.98% quarterly revenue increase

0.15% to 0.06%

60% reduction in

FX fees

-

Retaining IP customers due to high volume of exchange rate fees.

Enabling IP customers to add additional payout accounts for payments in their preferred currencies.

-

Integrated Platform customers face challenges with high exchange rate fees and inefficient workflows, leading to difficulties in client retention and stagnant revenue.

-

By enabling multi-currency features we aim to address these issues by reducing exchange rate fees, streamlining their payout processes, and ultimately driving revenue growth.

-

Customer feedback.

Conducted interviews and surveys with customers to understand their pain points relating to exchange rate fees and workflow inefficiencies.

Competitive Analysis.

Reviewed how competitors address multi-currency features and identified best practices.

Current workflow assessment.

Mapped out the existing payout and currency management processes and identified inefficiencies and areas for improvement.

Competitive analysis

I conducted thorough competitor analysis to benchmark our product's multi-currency feature. This involved researching key competitors to understand how they implemented similar features, examining their user interfaces, workflows, and overall user experience.

Customer feedback

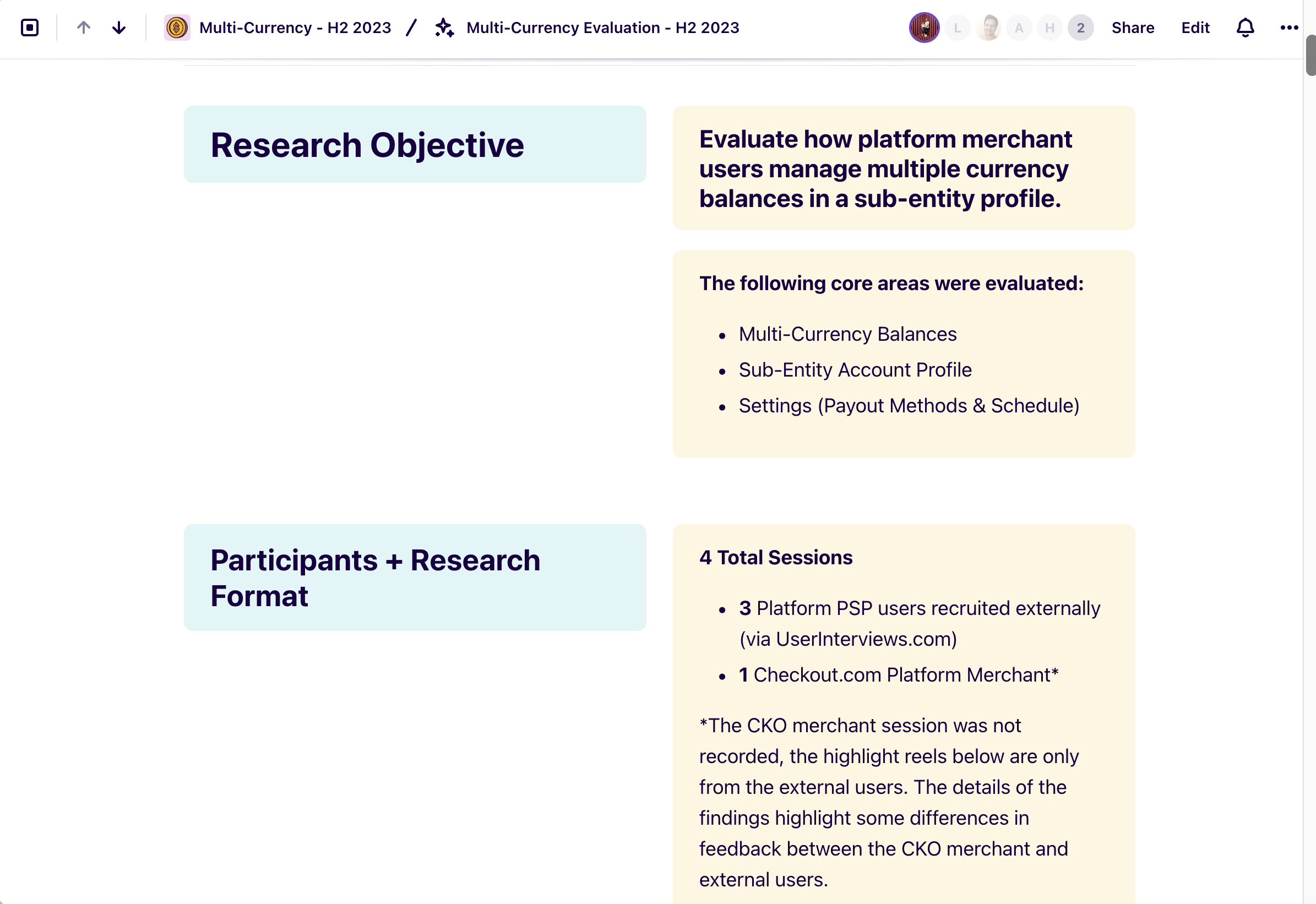

I developed surveys to assess our customers' understanding and invited them to complete their daily tasks on the dashboard when multiple currencies were displayed. The results helped us validate our design assumptions and refine our designs accurately based on customer feedback.

IA mapping

I carried out an internal information architecture (IA) mapping for the multi-currency feature to ensure a seamless user experience. This process involved evaluating the current structure of our dashboard, identifying key areas where the new feature would integrate, and organizing the information in a way that aligned with user needs. By mapping out the IA, I was able to pinpoint potential usability issues and streamline navigation, making it easier for users to manage multiple currencies efficiently. This groundwork was crucial in designing an intuitive and accessible multi-currency feature.

-

Feature specification.

Defined the requirements for multi-currency support, including adding payout accounts and balances.

Introduce multi-currency switch.

Implemented a currency switch in dashboard to filter and manage multiple currencies across the product.

Build prototypes.

Developed prototypes of the redesigned multi-currency dashboard, including new multi-currency features across the product.

Usability testing.

Tested the prototypes with a small group of users to gather feedback and make iterative improvements.

Deploy solutions.

Roll out the multi-currency features to all customers providing training and support materials to help customers adapt to the new features.

Monitor performance.

Track key metrics related to exchange rate fees, workflow efficiency, client retention, and revenue growth. -

Revenue growth.

Achieved an 8.98% quarterly revenue increase, from $325,537 to $354,764.

Reduced FX fees.

60% reduction in exchange rate fees, from 0.15% to 0.06%.

Multi-currency switch created

After extensive workshops and research on the optimal placement for the multi-currency switch, I designed an efficient solution that was seamlessly integrated into the customer dashboard.

Feature adoption

After introducing multiple currencies to the dashboard, the feature needed to be adopted across other areas of the customer's workflow. This included enhancing the payout process by allowing users to select the correct currency for each transaction and updating the scheduling feature to support configuring payouts in multiple currencies. These additions ensured a cohesive experience, enabling customers to manage their finances efficiently and accurately within a multi-currency environment.